How to invest in cryptocurrency

As DOGE mania waned in the latter half of the year, SHIB token took the spotlight, gaining 1,608% and taking the last slot in this year’s top 10. The success of DOGE and SHIB inspired several other tokens centered around the Japanese canine breed, including FLOKI, ELON, HOGE and DOGGY.< https://theodorhenriksen.com/ /p>

A cryptocurrency is a digital asset that can circulate without the centralised authority of a bank or government. According to CoinMarketCap, there are more than two million cryptocurrency projects out there that represent the entire $US2.23 trillion crypto market.

Both a cryptocurrency and a blockchain platform, Ethereum is a favorite of program developers because of its potential applications, like so-called smart contracts that automatically execute when conditions are met and non-fungible tokens (NFTs).

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

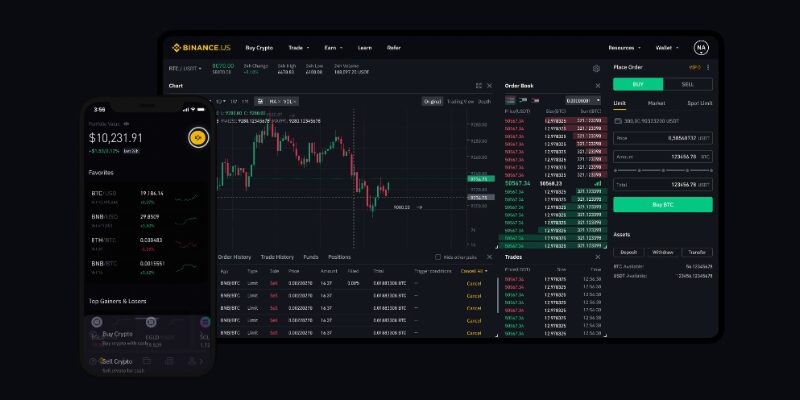

Cryptocurrency trading platform

If you’re an advanced crypto trader, you may want to make sure your preferred exchange offers the trading types—like limit orders, which can prevent slippage by setting a hard price—and margin you want. Remember trade types involving the latter are still evolving in the U.S., so different exchanges’ offerings may vary over time.

While Coinbase is a suitable digital asset exchange for both new and advanced crypto investors, trading fees can be relatively high, ranging from 0% to 0.60%, depending on trade volume. In addition, Coinbase’s user feedback is relatively poor. For instance, several Trustpilot users mention problems with customer support. Additionally, there are numerous stories of unexpected account closures that have tainted the exchange’s image.

To address this risk, centralized crypto exchanges have beefed up security over recent years. Among other strategies, they now store most customer assets offline and take out insurance policies to cover crypto losses in the case of hacking.

If you’re an advanced crypto trader, you may want to make sure your preferred exchange offers the trading types—like limit orders, which can prevent slippage by setting a hard price—and margin you want. Remember trade types involving the latter are still evolving in the U.S., so different exchanges’ offerings may vary over time.

While Coinbase is a suitable digital asset exchange for both new and advanced crypto investors, trading fees can be relatively high, ranging from 0% to 0.60%, depending on trade volume. In addition, Coinbase’s user feedback is relatively poor. For instance, several Trustpilot users mention problems with customer support. Additionally, there are numerous stories of unexpected account closures that have tainted the exchange’s image.

Future of cryptocurrency

Chainalysis will continue to advocate for regulatory frameworks that protect consumers and empower innovators by providing access to data, expert analysis and tools that contribute to a better understanding of recent events and their ongoing implications in the market.

Looking under the hood, KLIMA is backed by a variety of different carbon assets that are held in KlimaDAO’s treasury, including Moss’s MCO2 and Toucan Protocol’s BCT. The KLIMA token itself is instrumental for the Klimaconomy; it doesn’t just act as an incentive for users to lock carbon in the DAO’s treasury, it also acts as a “trading pair” within the DeFi markets. This means that KLIMA is used to facilitate market trades across different types of tokenized carbon assets.

While the most famous volte-face on policy towards crypto and blockchain belongs to JPMorgan, they are no longer alone among major financial institutions in embracing Web3. Arguably, just as boards and executive teams reluctantly owned their cybersecurity and digital transformation mandates, the embrace of crypto technology is equally inevitable, even if the term feels like a bad word. For all its faults, this technology remains a protagonist in the global financial world.

Meanwhile, policymakers who have been sounding an alarm about crypto’s excessive risks, while failing to create sensible regulations, have been vindicated by not one, but multiple large-scale failures.